Upcoming Sessions

Content Overview

The programme content is delivered over 5 weeks requiring you to work on multiple levels. Each week develops one part of the financial analysis framework, addressing overall the three following topics:

Financial Acumen

You are aware of the basic financial statements: Balance Sheet; Income Statement; and Statement of Cash Flows. But in order to help you use them effectively as a manager we will address the following questions:

- What unique set of information does each one of these financial statements contain?

- What information is still lacking?

- How are these financial statements connected to each other, and how can you exploit these connections to make better decisions?

- How do you use the financial statements to evaluate the success or failure of past strategic decisions?

Drivers of Financial Decision Making

Effective leaders are able to leverage financial information to make strong strategic decisions. You will explore the diverse inputs and the processes you need to follow to enhance your decision-making. This means thinking deeply about key questions:

- How do you link financial and non-financial performance measures to your project’s or overall organisation’s strategy and objectives?

- Why is it vital to include opportunity costs and exclude sunk costs in value-based decision making?

- How can you develop a method for identifying relevant information for every type of organisational decision?

- What are the trade-offs of using performance measures to explicitly incentivise employees?

Valuation Framework

Leading with impact and confidence means bringing different concepts together, and thinking deeply about how your decision-making can create value for your organisation. We will explore some of the key dimensions involved:

- Why is the metric Return on Invested Capital (ROIC) important?

- How can we use ROIC to evaluate productivity?

- How does ROIC relate to free cash flow and valuation?

- What are the preferred methods we can use to make strategic decisions based on forecasts of ROIC and value?

*For the weekly detailed content of the programme, please refer to the brochure.

Your Online Learning Journey

Throughout the programme, an INSEAD Learning Coach will be guiding you and helping you maximise the impact of your learning journey.

*Please note the programme may include a pause week(s).

Action Learning Project

Your Action Learning Project (ALP) is a unique opportunity to apply your learning to your own business context. The ALP will take you on a step-by-step journey to develop a financial perspective on a current business decision you are facing. You will identify a specific strategic opportunity and then quantify the predicted financial effects of various possible outcomes following a recommended action.

Working directly with a learning coach, you will design the ALP that best fits with your personal learning objectives.

There are three phases to the ALP process:

- First, you will agree on the scope of your ALP with the learning coach, to make sure it aligns with the learning objectives of the programme and culminates in a concrete goal.

- Second, in each of the five content weeks, you will apply the tools and concepts from that week to your ALP.

- Third, following the completion of the course work you will synthesise your weekly submissions to propose a concrete strategic recommendation based on solid financial analysis. Your final submission will be subject to peer review. All participants will review four other submissions and provide peer feedback. The final ALP and peer review process normally takes between 10-12 days after the programme content finishes.

ALP objectives :

- Use financial analysis to articulate a key management challenge

- Use the valuation tools from the course to propose a compelling forward-looking strategy to tackle the challenge

- Back up the planned execution of your recommended strategy with a convincing financial evaluation.

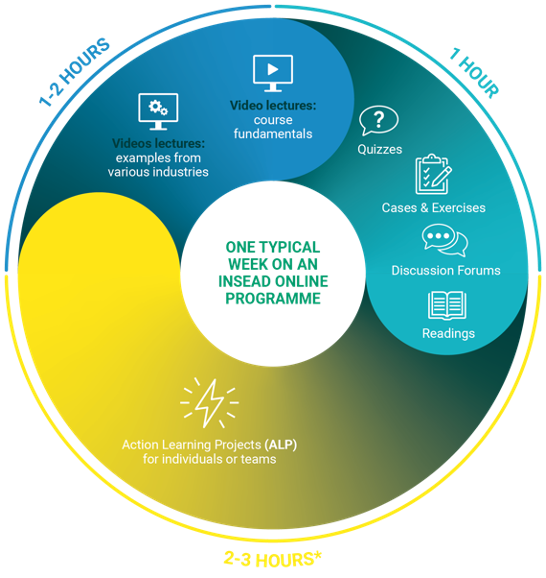

Typical Week on an INSEAD Online Programme

Each week of content follows a very clear path to facilitate learning for busy executives. The platform allows participants to learn at their own pace during each week, by viewing the content, completing assignments and engaging in discussions, taking on average 4-6 hours per week* to complete.

*This is the recommended number of hours per week however please note that working on the Action Learning Project (ALP) may require up to two additional hours/week.