Six months after its inception at SDG Week 2020, Chris Holcroft (20D), former President and Co-founder of the INSEAD Student Impact Fund reflects on what it has achieved so far.

The 8th of January 2020 was my first day at INSEAD, and there was no indication of the disruption and turmoil that COVID 19 would cause the world soon after. In March, all expectations of what a traditional MBA experience at INSEAD changed as numerous countries went into a first of many lockdowns. But out of this turmoil came a unique opportunity.

INSEAD did not yet have an investment vehicle for students to participate and learn about early stage investing. With the growing importance of ESG, impact investing, and the healthy appetite of students looking to gain experience in the social impact sector, my co-founders Borja Menendez (20D), Charles Cochin de Billy (20D) and I launched INSEAD’s first Student Impact Fund (ISIF).

ISIF was founded with two impact theories of change in mind. Chief among these was the desire to provide a learning opportunity to INSEAD students to invest in early stage social and environmental enterprises. The second was an ambition to have additionality in financing enterprises that are often overlooked by purely profit minded investors, thereby extending the access to capital of impact minded businesses.

During the initial months of research, thorough benchmarking of other university impact funds and extensive alumni conversations, we meet Kamal Hassan and Michael Kosic of Loyal VC, who as INSEAD alumni, entrepreneurs and angel investors, had designed the VC fund they wished they had had as entrepreneurs. By September 2020, a partnership with Loyal had been agreed and an initial pilot was launched.

Here’s what we managed to accomplish so far:

Deal Sourcing

Students have managed the entire INSEAD portion of Loyal’s deal sourcing (~40% of deals) and have held four Investment Committees to date. The committee consists of two students, one Loyal Partner, one faculty advisor and one INSEAD affiliate advisor. In total, 18 companies were assessed of which 14 were presented to the IC. Of these, seven stage one investments of $10,000 have been made, across five industries and six countries. Companies that have received investments are: Senopi, SpotShip, Cultisan, Gridduck, Qboid, Elfie and Circular Rubber.

Due Diligence

The due diligence team have carried out three follow-on investment due diligences so far. Given the greater size of investment at stage two ($200K) and stage three ($1m), students conduct a deeper analysis of the market, impact and financials of the target companies. The decision for follow-on is taken on a rolling basis with discussions ongoing on all of Boost Capital, Inseact and Zumi.

Impact Assessment

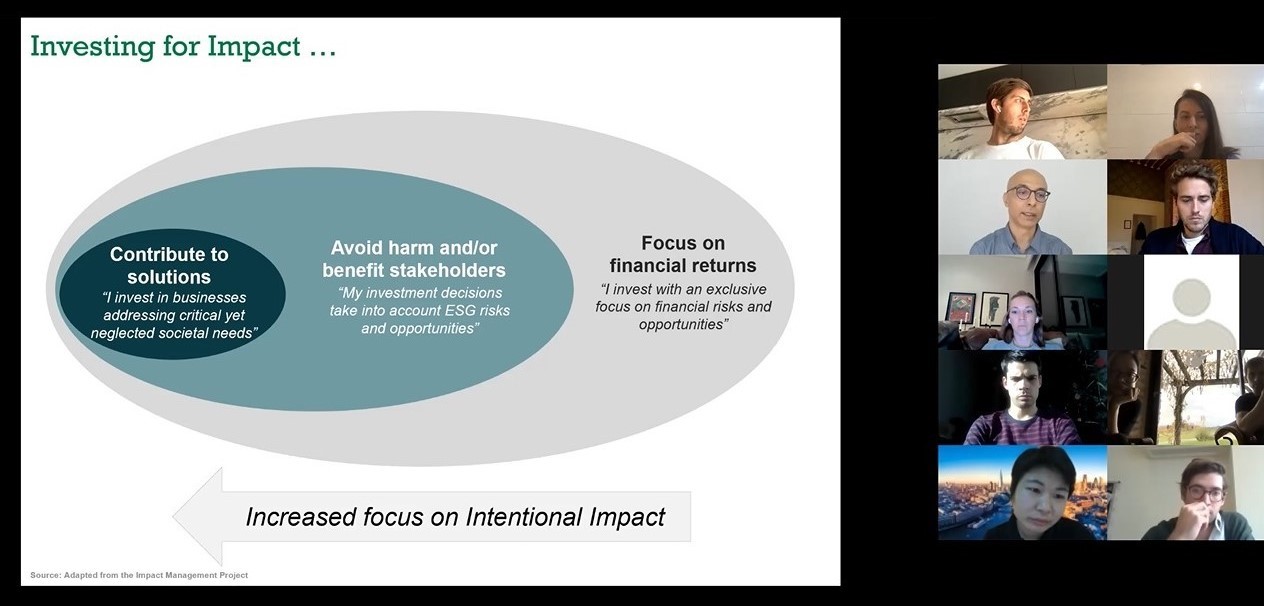

Taking a dual approach to impact measurement, the club has applied a forward looking qualitative assessment of impact based on IMPs 5 Dimensions, to companies at the deal sourcing and due diligence stages of the investment cycle. Concurrently, it supports the portfolio management team in applying Loyal’s in-house impact accounting framework to portfolio companies seeking to quantify an impact multiple of money. To date, the team has completed 14 deal sourcing impact assessments, three due diligence assessments and two impact accounting assessments.

Portfolio Management

Members of this team attend monthly performance review calls with the founders of existing Loyal portfolio companies. With over 130 portfolio companies to choose from, the club tries to align students with companies where they can add value based on their sector specific knowledge and experience. As students track and become more familiar with their respective companies, they support the founders with short-term advisory projects. To date, students have supported 6 companies and have attended 12 individual founder calls.

Fundraising

As an evergreen fund, Loyal VC are continuously fundraising. Students in the club have the unique opportunity to learn how to fundraise and support Loyal in growing the fund. Any funds raised by students secure investment decision rights for the club, and are accompanied by a charitable kick back for INSEAD. To date, students have reached out to over 50 potential investors from the alumni community leading to three introductions to the Loyal partners. Of these, one has invested and joined Loyal as a Limited Partner.

As with all INSEAD clubs, the reigns are passed on every 6 months and in December 2020, ISIF saw its first successful handover to the 21J promotion. The Presidency is passed on to Emilie Abrams (21J) who will preside over a leadership team that is as diverse in background as gender, with 50% of new VPs being female.

In taking over the reigns of ISIF, Abrams has worked tirelessly to gain academic recognition and official course credits for the work student conduct in ISIF. With the approval of Urs Peyer, Academic Dean of INSEAD, secured students will now be able to submit Independent Study Projects (ISPs) on the work they have led in ISIF. With this new milestone reached, ISIF moves one step closer to becoming fully integrated in the INSEAD academic ecosystem.

We owe a final word of gratitude to all those who have supported this initiative and provided us with guidance along the way, especially Kamal and Michael, from Loyal VC, and INSEAD Professors Vikas Aggarwal, Lucie Tepla and Jasjit Singh – who make up our faculty advisory board. We also thank Hoffmann Institute’s Founding Executive Director, Katell Le Goulven, the Hoffmann Institute, and to the countless alumni who supported us.

In partnership with the Hoffmann Institute, Loyal VC is also offering internships for INSEAD students. To access the full details and to apply, visit CareerGlobe and search for ID31860. Good luck!

Subscribe to our Hoffmann Institute Quarterly Newsletter

Stay informed on our 60 second quarterly video updates, stories, video recordings of our webinars, and details of upcoming events and much more.